How To Get A 1099 G Form From Unemployment Online

How to Get Your 1099-G online. Remember even if you were unemployed you still have to file income taxes.

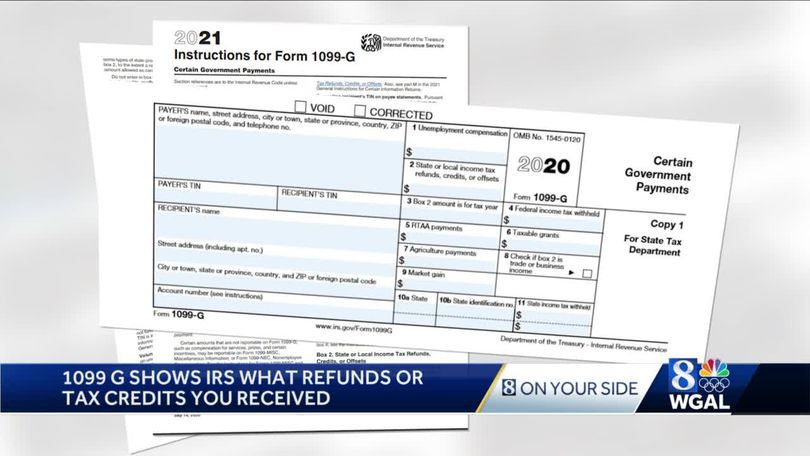

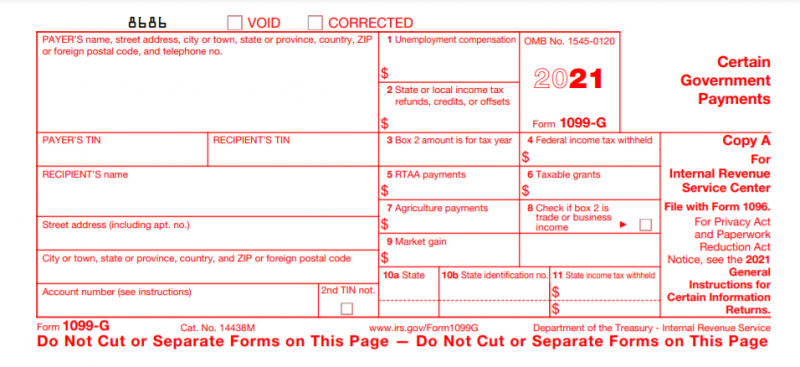

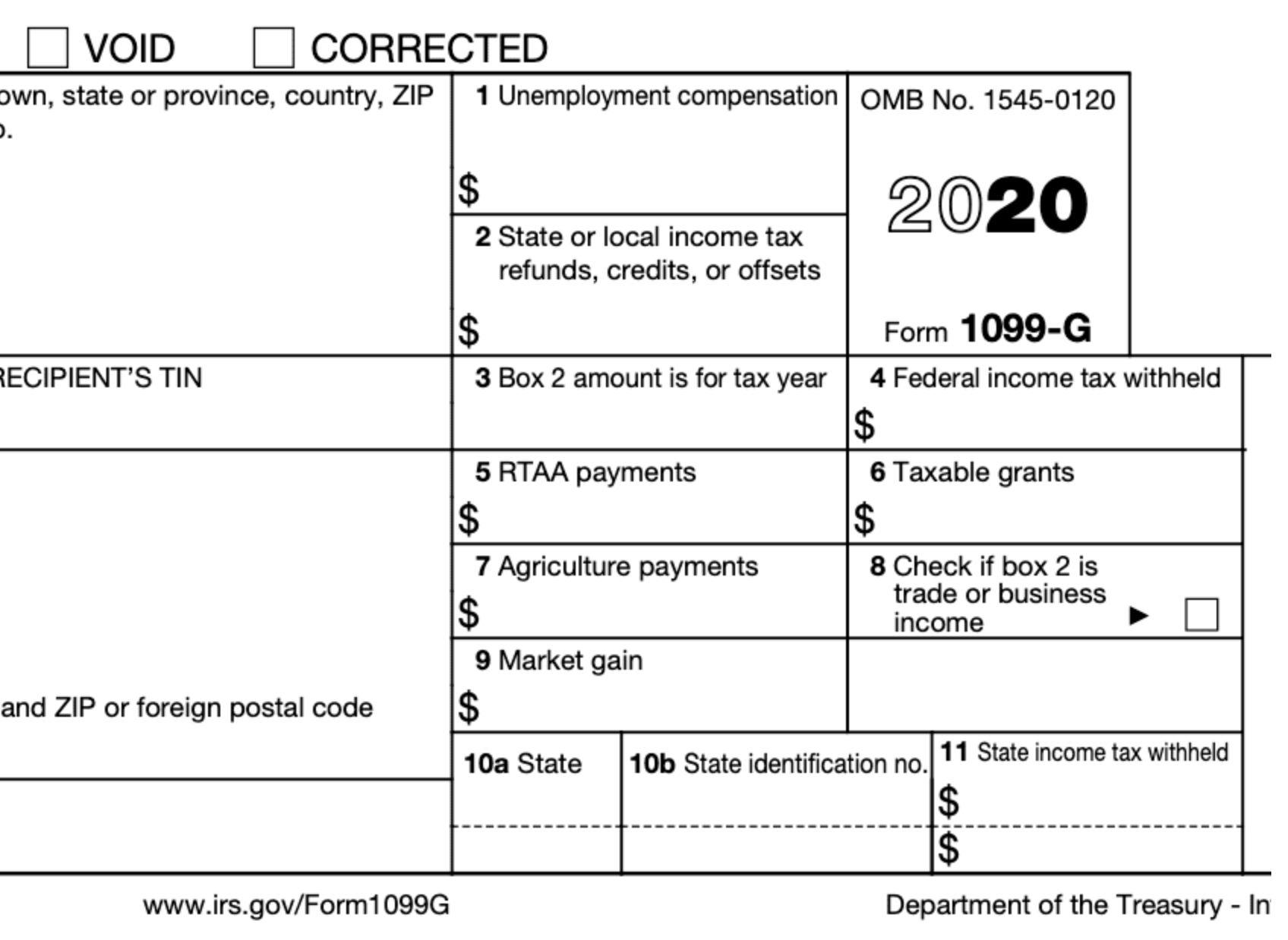

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

I have not received my 1099-G form and have been trying to get it through my state unemployment department and the IRS website but keep hitting walls.

How to get a 1099 g form from unemployment online. A 1099G is issued if you received 10 or more in gross unemployment insurance payments. We will mail you a paper Form 1099G if you. To access this form please follow these instructions.

If you are requesting your 1099G to be sent to another address than what we have on file you will be required to submit proof. Click on the down arrow to select the right year. You can view 1099-G forms for the past 6 years.

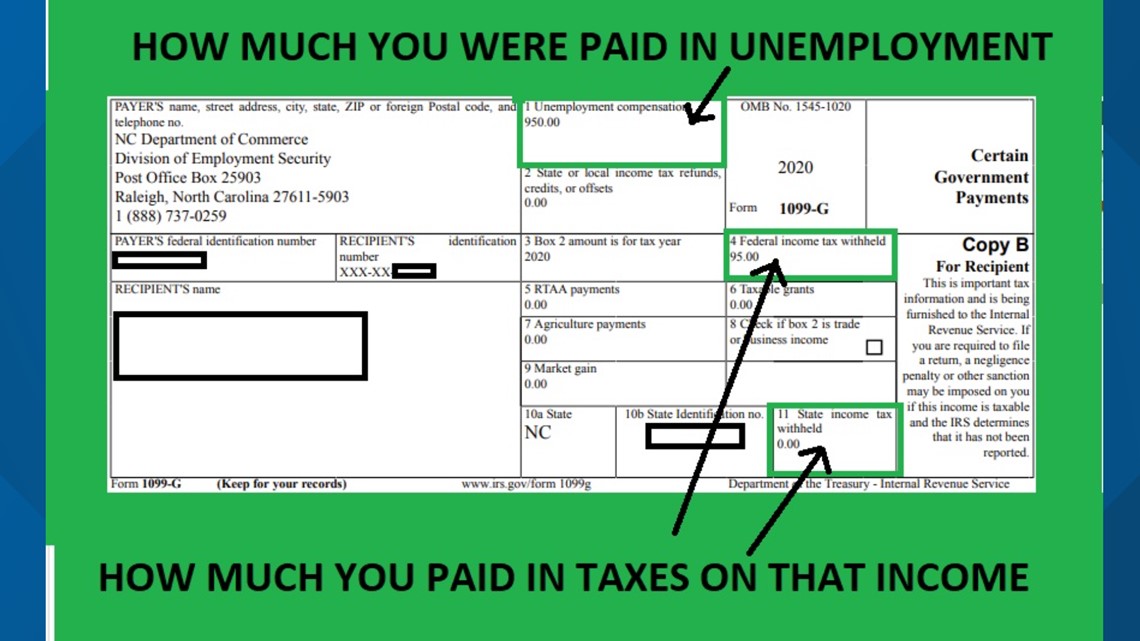

These forms are available online from the NC. Enter the amount from Box 1 on Line 19 Unemployment Compensation of your 1040 form. Written requests for a hard copy of your 1099-G form from 2018 2019 2020 or 2021 may be.

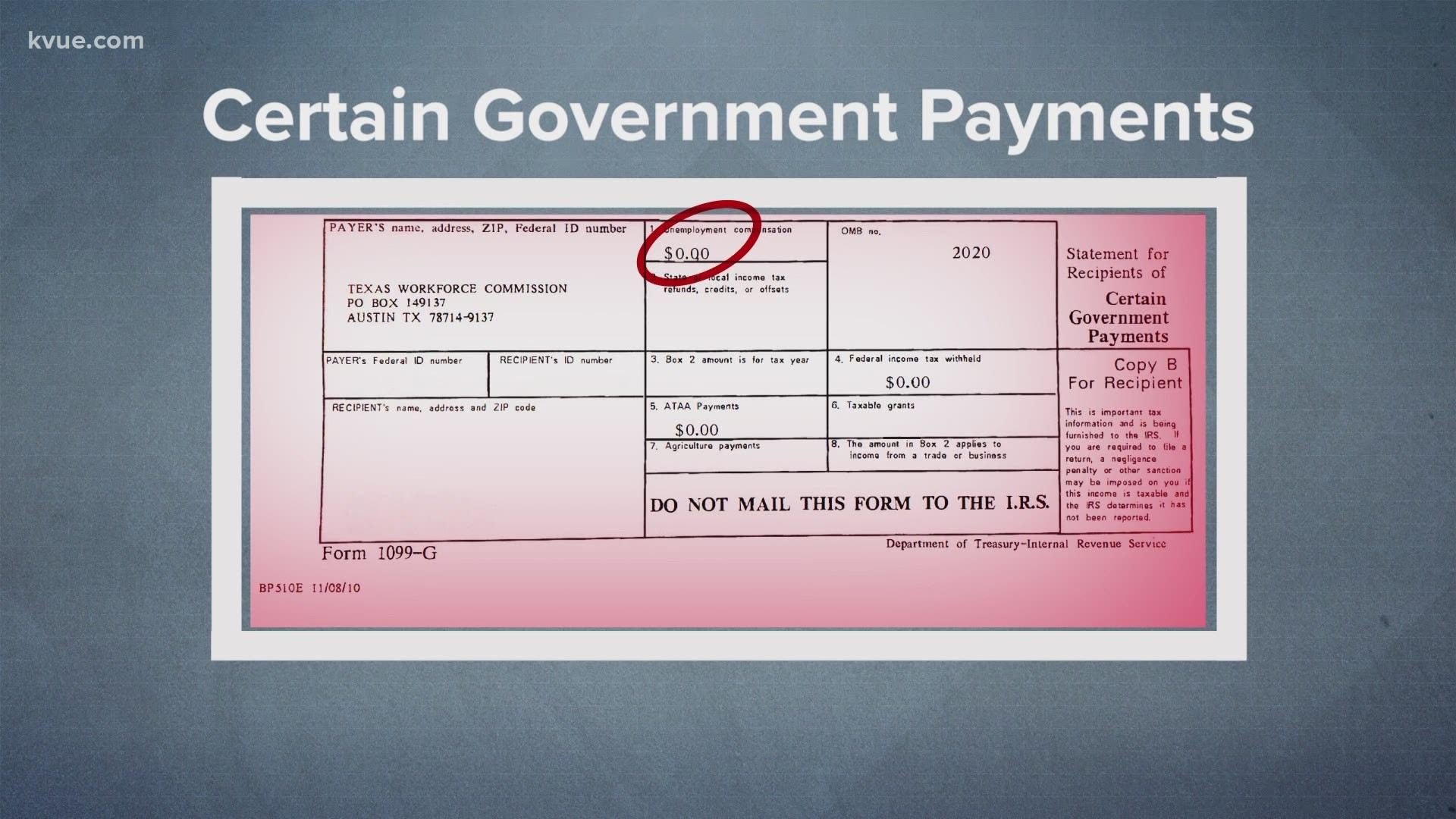

Pacific time except on state holidays. If you see a 0 amount on your 2020 form call 1-866-401-2849 Monday through Friday from 8 am. The most common use of the 1099-G is to report unemployment compensation as well as any state or local income tax refunds you received that year.

Log in to your UI Online account. From the Unemployment Insurance Benefits Online page below under the Get your NYS 1099-G section select the year you want in the NYS 1099-G drop-down menu box with an arrow and then select the Get Your NYS 1099-G button. If this amount if greater than 10 you must report this income to the IRS.

The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021. For Pandemic Unemployment Assistance PUA claimants the. You can also download your 1099-G income statement from your unemployment benefits portal.

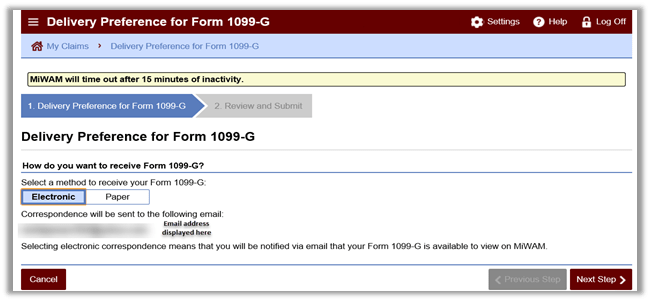

Email alerts will be sent to the claimants that elected to receive electronic notifications advising that they can view and print their 1099G online. After logging in click View Correspondences in the left-hand navigation menu or in the hamburger menu at the top if youre on mobile. The 1099G form reports the gross.

If you get a file titled null after you click the 1099-G button click on that file. Most claimants who received Pandemic Unemployment Assistance PUA benefits during 2020 can access their 1099-G form within the MyUI application. On your 1099-G form Box 1 Unemployment Compensation shows the amount you received in unemployment wages.

Look for the 1099-G form youll be getting online or in the mail. You can access your Form 1099G information in your UI Online SM account. We mailed you a paper Form 1099G if you have opted into paper mailing or are a telephone filer.

These forms will be mailed to the address that DES has on file for you. If you received a 1099-G tax form and. Anyone who repaid an overpayment of unemployment benefits to the State of Arizona in 2020 will also receive a 1099-G form.

Click on View 1099-G and print the page. When you apply for unemployment insurance benefits you can choose to have 10 of your weekly benefit amount withheld for federal income taxes andor 6 for state income taxes. You can access your Form 1099G information on your Correspondence page in Uplink account.

Please fill out the following form to request a new 1099 form. Ive heard that if I file myself online which I usually do and dont add my 1099 the IRS will basically fix it and send me a bill. Click on View and request 1099-G on the left navigation bar.

IDES began sending 1099-G forms to all claimants via their preferred method of correspondence email or mail in late January. Applicant Services 1099 Information The 1099s reflecting unemployment benefits paid in 2020 will be mailed to the last address on file no later than January 29 2021. You must complete all fields to have your request processed.

1099G is a tax form sent to people who have received unemployment insurance benefits. Form 1099G is now available in Uplink for the most recent tax year. If you have additional questions about accessing your 1099-G form please call IDES at 800 244-5631.

1099-Gs for years from 2018 forward are available through your online account. You may download a copy of your current IRS Form 1099-G through your online account at desncgov at no charge. Form 1099-Gs issued from 2009 through 2019 are available online by logging into the unemployment benefit system and going to your correspondence box.

If you need a Form 1099-G for a year prior to 2009 please contact the Unemployment Hotline at 603 271-7700 and speak with a. Resources for reemployment assistance along with information on filing an unemployment claim and details on how employers can file partial claims can be found on the agencys webpage at https. You may choose one of the two methods below to get your 1099-G tax form.

Regardless of the initial method of delivery all claimants can access copies of their 1099-G form in multiple ways. Unemployment is taxable income.

Millions Of Americans Victimized By Unemployment Fraud Orbograph

Millions Of Americans Victimized By Unemployment Fraud Orbograph

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Labor And Economic Opportunity How To Request Your 1099 G

Labor And Economic Opportunity How To Request Your 1099 G

1099 G Fill Online Printable Fillable Blank Pdffiller

1099 G Fill Online Printable Fillable Blank Pdffiller

Unemployment Benefits Are Taxable Look For A 1099 G Form Khou Com

Unemployment Benefits Are Taxable Look For A 1099 G Form Khou Com

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Printable 1099 G Form Get 2020 Blank And Fill It

Printable 1099 G Form Get 2020 Blank And Fill It

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

The Irs 1099 G Form What It Is And Who Receives

The Irs 1099 G Form What It Is And Who Receives

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Unemployment Fraud Reports Running Rampant In Central Ohio

Unemployment Fraud Reports Running Rampant In Central Ohio

1099 G Scheduled To Be Mailed On Or Around Jan 27 Hawaii News And Island Information

1099 G Scheduled To Be Mailed On Or Around Jan 27 Hawaii News And Island Information

1099 G 2018 Public Documents 1099 Pro Wiki

1099 G 2020 Public Documents 1099 Pro Wiki

1099 G 2020 Public Documents 1099 Pro Wiki

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes