How To Amend A Business Activity Statement

Open the return then click Amend. Request a refund or transfer funds between accounts.

You do this by completing a business activity statement BAS.

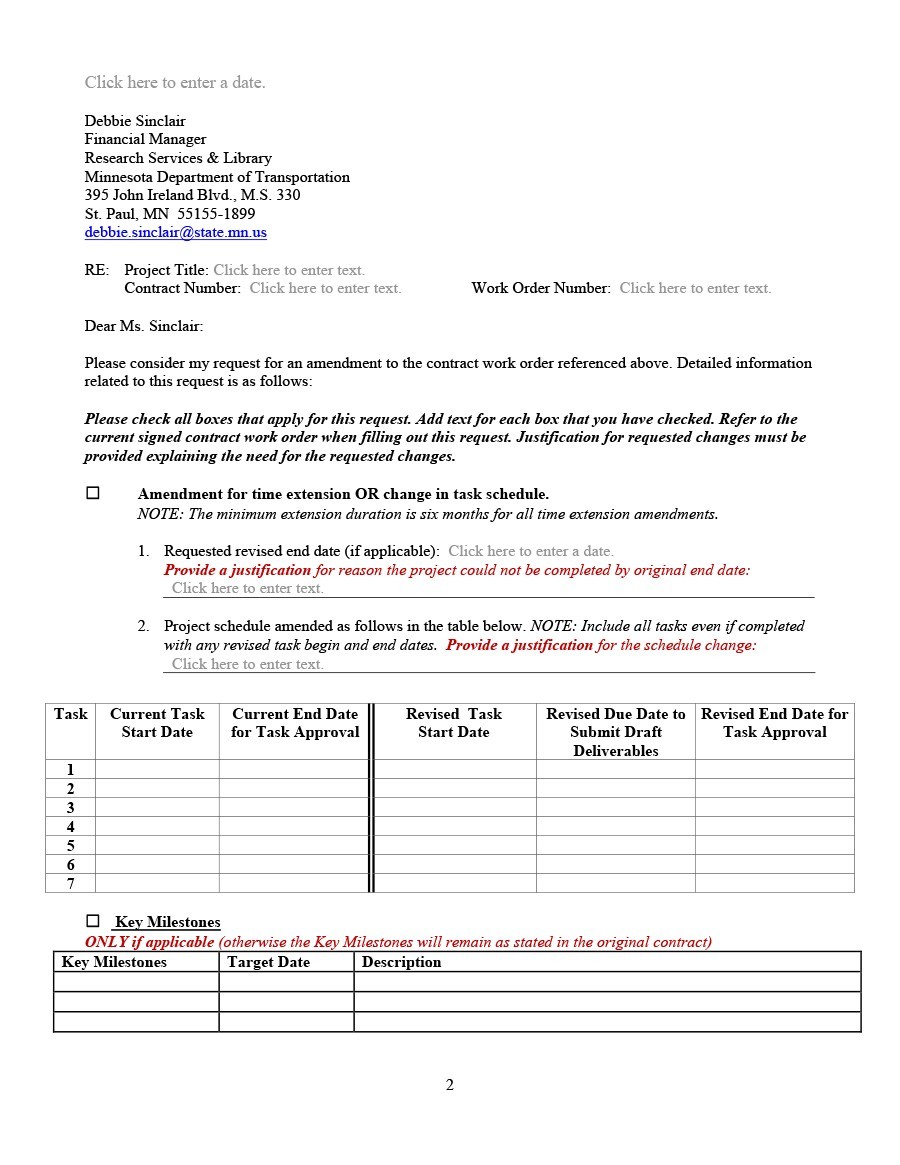

How to amend a business activity statement. There is a change in your business activity and you want to continue hiring your foreign workers. Applying for an amendment using a revised activity statement. Under Tax click Activity Statement.

If playback doesnt begin shortly try restarting your device. Your BAS will help you report and pay your. If an organization files an annual return such as a form 990 or 990-EZ it must report the changes on its return.

An exempt organization must report name address and structural and operational changes to the IRS. We amend the assessment in full as a result of the application that is we fully accept. Update your Activity Statement settings if your registration details change.

Your BAS helps you to report and pay your GST PAYG instalments PAYG withholding tax and other taxes. Other Income Loss Line 5. You can use the Business Portal to.

Other Forms and Statements That May Be Required. Through a registered tax or BAS agent. Principal Business Activity Codes.

Changing settings deletes any draft Activity Statements youve saved. Edit - Edit the Business Activity Statement. Amend a filed activity statement.

You can lodge your BAS. Online through the Business Portal or Standard Business Reporting SBR software. Revising activity statements Use the correct DIN.

The statement of activities is a required financial statement for many purposes. Find out what to do if you need to fix a mistake on a previously lodged business activity statement BAS or make an adjustment. Goods and services tax GST pay as you go PAYG instalments.

Lodging an activity statement through the business portal. Print - Print the Business Activity Statement. Once you lodge online your BAS will be sent electronically.

Has anyone else noticed that if they were to report exactly as per the reports Xero compiles re Activity Statements that they are providing misleading and inaccurate figures to the ATO. How you complete your BAS depends generally on your business registrations. In the Tax menu select Returns then select the Filed tab.

Information you will need Youll need a record of how much GST you collected on sales and how much was paid on purchases. In the Accounting menu select Reports. Complete and return by the due date on your BAS along with any payment due.

Where you apply for an amendment using a revised activity statement paper RBAS or lodge electronically via Standard Business Reporting SBR Online services for agents or portal a notice of amended assessment will not issue when. Click Save continue. Statements and forms required of S corporations electing to be treated as an entity under.

Original and revised activity statements must have different document identification numbers DINs. If we processed an activity statement then receive lodgment of another activity statement with the same DIN it can lead to incorrect refunds and account balances as well as processing delays. Amend an activity statement after youve filed it with the ATO.

View statements of account and find your payment reference number PRN view your Single Touch Payroll STP reports. Where an original lodged Activity Statement is present in Tax Manager right clicking on that return in Tax Manager and selecting Activity Statement Amendment will create a copy of the original return for amending. Once you have cleared your tax liabilities you can mark it as paid.

The Business Activity Statement created will reflect in the BAS Statement Log. A single electronic lodgment will change how the next BAS is issued. If approved you can get a new CPF account to hire the workers.

Business activity statements BAS If you are a business registered for GST you need to lodge a business activity statement BAS. The IRD may ask to see them later. 31 Mar 2021 QC 43304 Footer.

Activity statement types and settings. Update your business registration details including email addresses. Xero compiles 3 reports - a GST Calculation Worksheet a Business Activity Statement and a GST Audit Report.

If you own a business in Australia you must report and pay your business taxes to the Australian Taxation Office ATO using a Business Activity Statement BAS. The Australian Taxation Office ATO will send your activity statement about 2 weeks before the end of your reporting period. Other Income Loss Line 12a.

Click Settings then make the required changes. If your nonprofit client is having its records reviewed or audited it must have a statement of activities. Other Forms and Statements That May Be Required.

Prepare lodge and revise activity statements. A copy of the original statement is created in Draft and has Amendment nn next to its name. In addition its typically required as part of the supporting documents if your client goes to a bank to try and get a loan.

You wont need to submit tax invoices when you lodge your GST return but you will need to have them on hand. Click on the three dots to. View - View the Business Activity Statement.

There are several options for lodging your business activity statements BAS. Finalised statements arent affected. If the organization needs to report a change of name see Change of Name- Exempt Organizations.

To change or add a business activity submit a request and upload the relevant supporting documents of the new business activity.

Simple Llc Operating Agreement Template 11 Operating Agreement Template For A Secure Company Management Operating Agr Templates Agreement Contract Template

Simple Llc Operating Agreement Template 11 Operating Agreement Template For A Secure Company Management Operating Agr Templates Agreement Contract Template

Photography Copyright Business Owner Small Business Tips Small Business Accounting

Photography Copyright Business Owner Small Business Tips Small Business Accounting

33 Proposal Writing Format Sample Example A Proposal Essay For Project Writin Business Proposal Letter Business Proposal Template Writing A Business Proposal

33 Proposal Writing Format Sample Example A Proposal Essay For Project Writin Business Proposal Letter Business Proposal Template Writing A Business Proposal

First Income Tax Form One Page Tax Forms Income Tax Tax Day

First Income Tax Form One Page Tax Forms Income Tax Tax Day

12 Business Continuity Plan Templates Word Excel Pdf Templates Business Continuity Planning Business Continuity Business Contingency Plan

12 Business Continuity Plan Templates Word Excel Pdf Templates Business Continuity Planning Business Continuity Business Contingency Plan

And Colourscheme8 1 Evaluation And Control The Action Plan Above Would Be Regularly Reviewed Andevaluated To Make Room How To Plan Marketing Plan Action Plan

And Colourscheme8 1 Evaluation And Control The Action Plan Above Would Be Regularly Reviewed Andevaluated To Make Room How To Plan Marketing Plan Action Plan

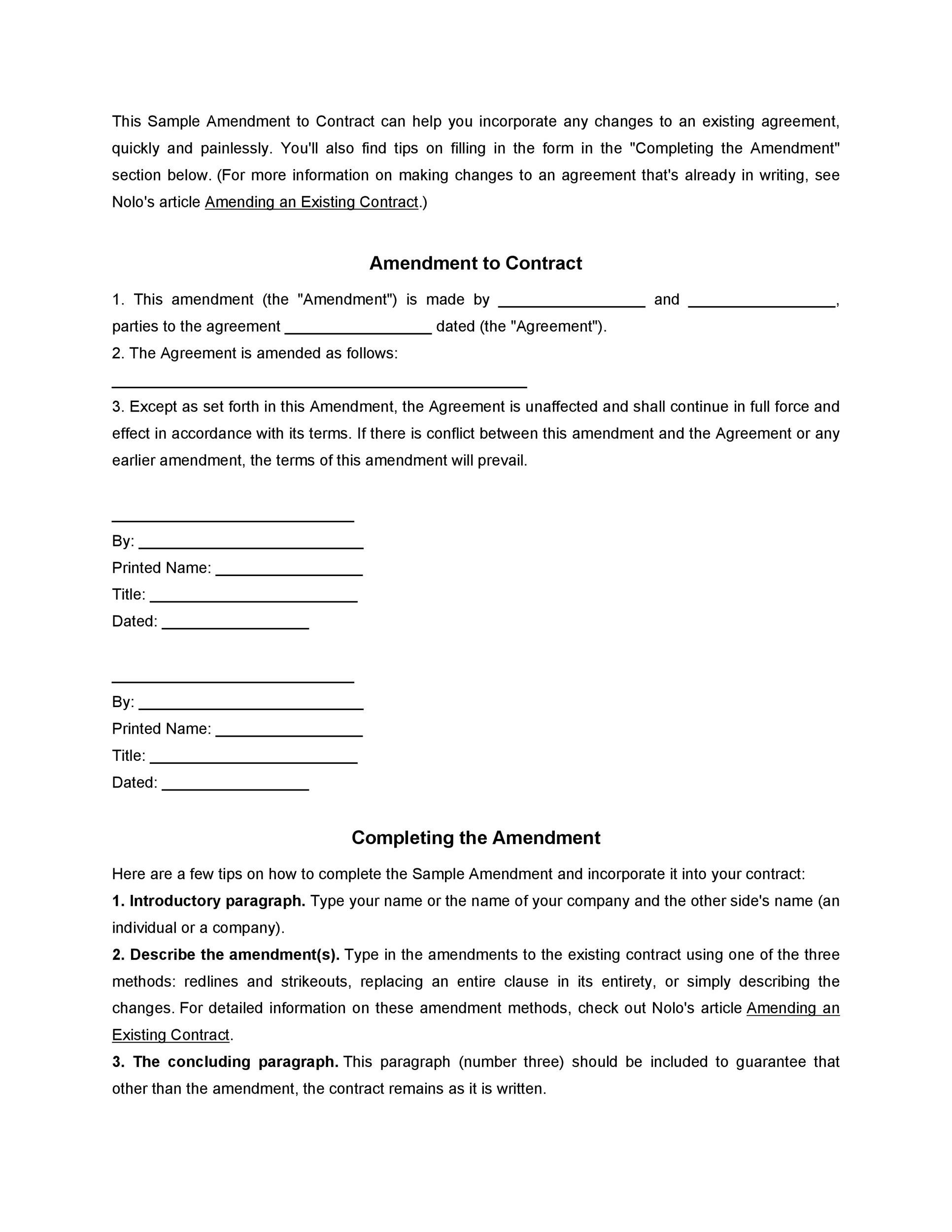

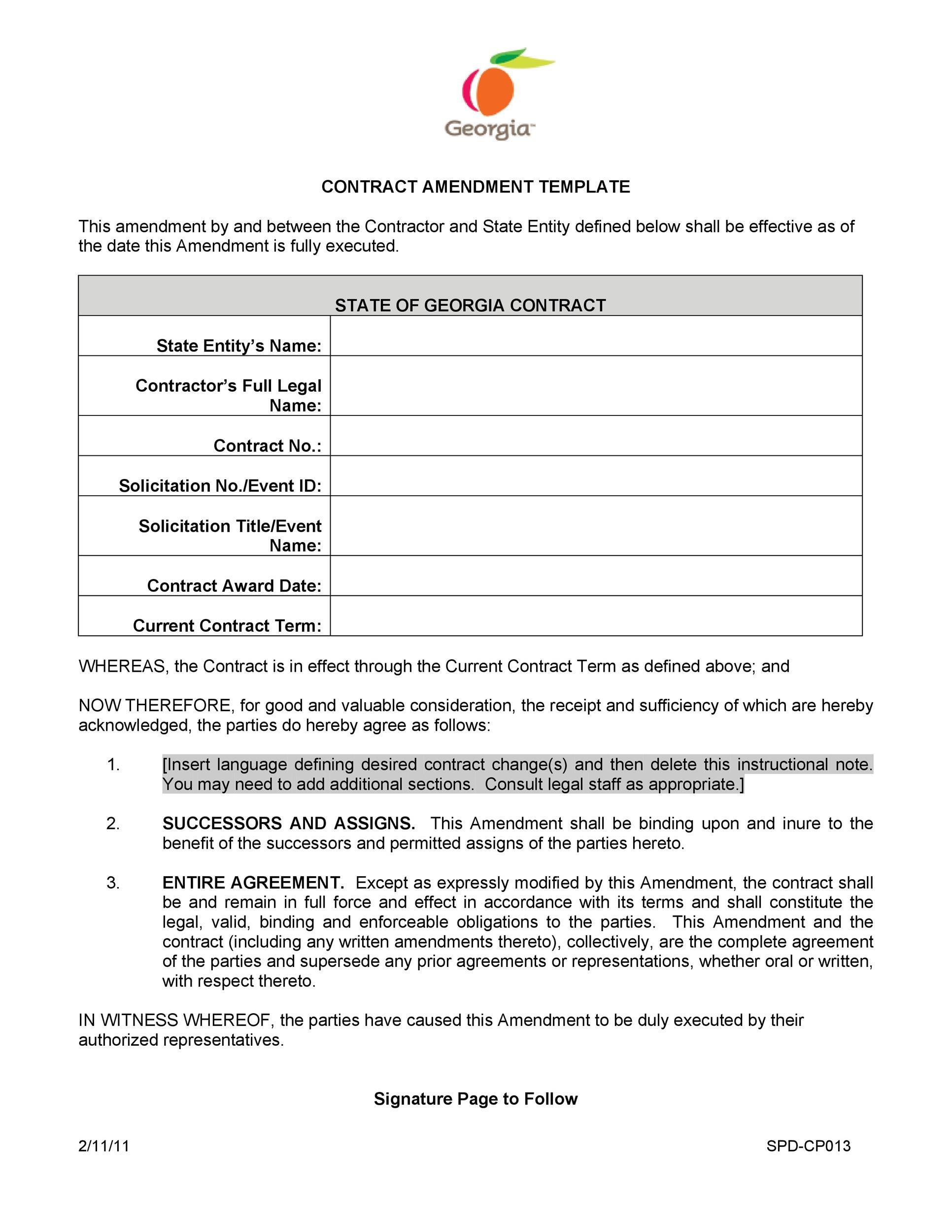

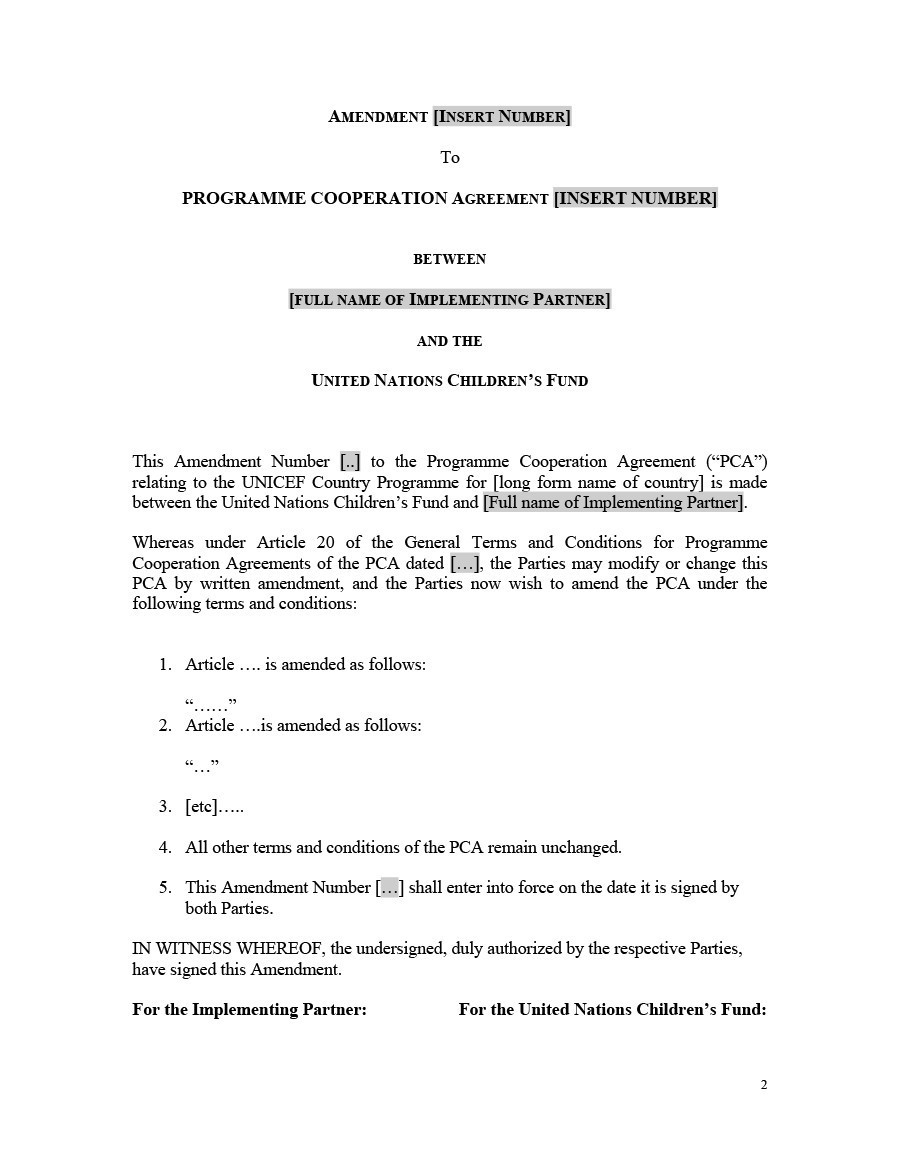

Sample Amendment To Agreement Contract Template Custom Return Address Labels Templates

Sample Amendment To Agreement Contract Template Custom Return Address Labels Templates

Construction Company Health And Safety Policy Statement Safety Policy Health And Safety Safety Management System

Construction Company Health And Safety Policy Statement Safety Policy Health And Safety Safety Management System

Govreports Brochure Payroll Taxes Brochure Tax Return

Govreports Brochure Payroll Taxes Brochure Tax Return

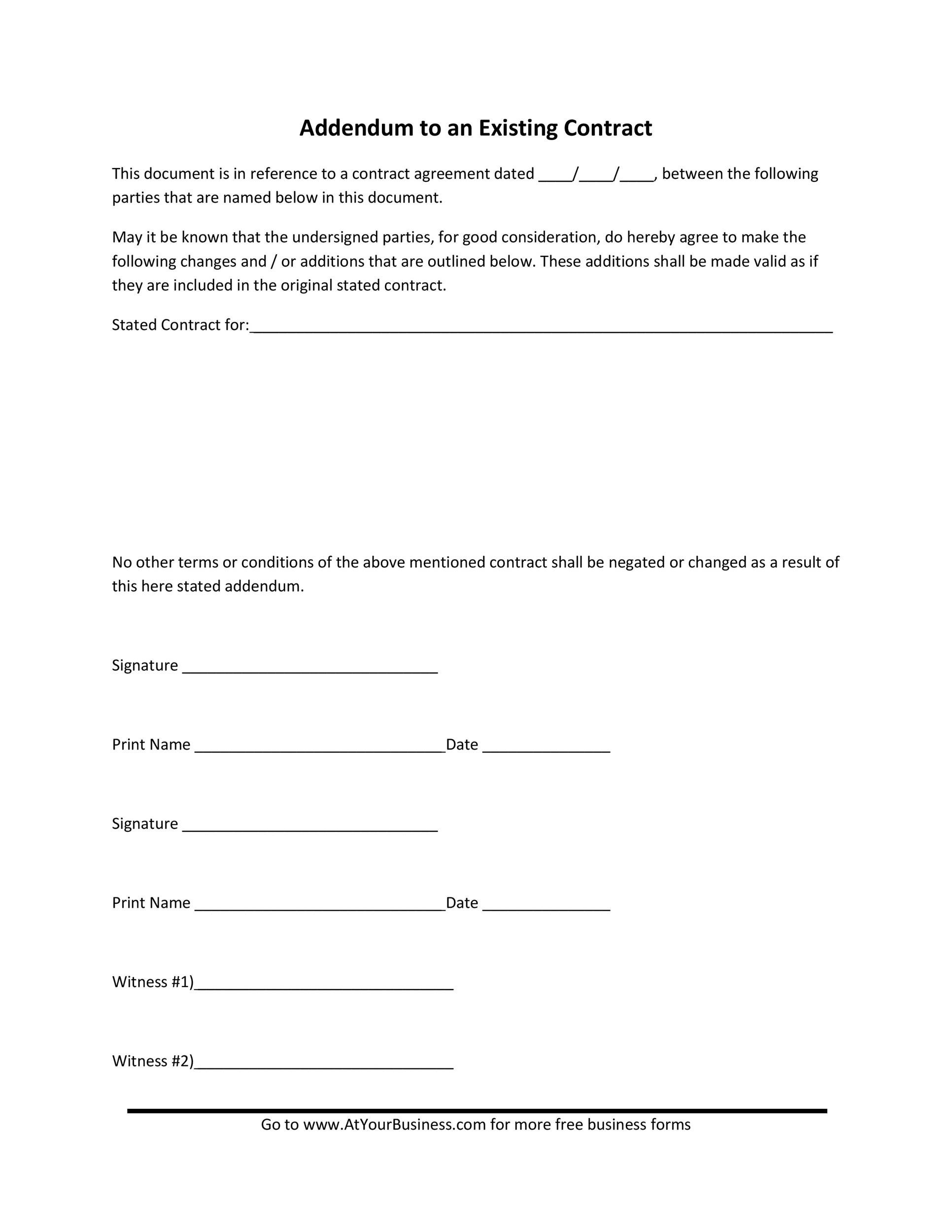

Addendum Agreement Sample Template Business Template Templates Agreement

Addendum Agreement Sample Template Business Template Templates Agreement

Certificate Of Insurance Request Form Template Fresh Certificate Insurance Request Form Templat In 2020 Certificate Of Achievement Template Templates Business Template

Certificate Of Insurance Request Form Template Fresh Certificate Insurance Request Form Templat In 2020 Certificate Of Achievement Template Templates Business Template

Service Level Agreement Template Functional Photos Outsourcing Marevinho Service Level Agreement Virtual Assistant Services Agreement

Service Level Agreement Template Functional Photos Outsourcing Marevinho Service Level Agreement Virtual Assistant Services Agreement

Instagram For Artists Essentials For Getting Started Instagram Instagram Artist Statement Art

Instagram For Artists Essentials For Getting Started Instagram Instagram Artist Statement Art

Explore Our Image Of Amendment To Promissory Note Template Promissory Note Notes Template Templates

Explore Our Image Of Amendment To Promissory Note Template Promissory Note Notes Template Templates